ADMISSIONS

Tuition &

Financial Aid

Since our school’s founding, CAC’s board of directors has made it a goal to create an opportunity for a Christian education that is affordable to as many families as possible. We seek to partner with families to educate children for a life of service to God. While the primary responsibility for financing a student’s education rests with the family, we seek to accomplish this goal by keeping tuition costs as low as possible and by offering financial aid to families who need assistance.

Tuition Information

Prices reflect the total cost for the full academic year.

| 2024-2025 Elementary Tuition (Pre-K – 5th Grade) | Cost |

|---|---|

| Pre-K Tuition: Five Day Core (8 a.m. to 11:45 a.m.) | $6,419 |

| Pre-K Tuition: Five Day Extended Day (8 a.m. to 3 p.m.) | $8,752 |

| Pre-K Tuition: Three Day Core (8 a.m. to 11:45 a.m.) | $3,899 |

| Pre-K Tuition: Three Day Extended Day (8 a.m. to 3 p.m.) | $5,298 |

| Pre-K Tuition: Two Day Core (8 a.m. to 11:45 a.m.) | $2,641 |

| Pre-K Tuition: Two Day Extended Day (8 a.m. to 3 p.m.) | $3,571 |

| Tuition: Kindergarten | $9,850 |

| Tuition: Grades 1 – 5 | $10,671 |

| Registration Fee (per student, nonrefundable) | $50 |

| Enrollment Fee (per student, nonrefundable, not prorated) | $400 |

| Grades K-5 Facility & Technology Fee (per student, nonrefundable, not prorated – limit two per family) | $350 |

| 2024-2025 Secondary Tuition (Grades 6-12) | Cost |

|---|---|

| Tuition: Grade 6 | $10,671 |

| Tuition: Grades 7-12 | $11,628 |

| Registration Fee (per student, nonrefundable) | $50 |

| Enrollment Fee (per student, nonrefundable, not prorated) | $400 |

| Grades 6-12 Facility & Technology Fee (per student, nonrefundable, not prorated – limit two per family) | $450 |

Tuition Discounts

Prepayment

Discounts

(Full-time students only)

- Full Pay – $100 discount when tuition is paid in full on or before July 15

- Semester – $30 discount per semester (must be paid by July 15 & Jan 15)

Sibling Tuition

Discounts

- Second Student – $300

- Each Add’l Student – $1,000

Preschool

Discount

Sponsoring Church Member – Members of the Pleasant Valley Church of Christ will receive a 5% member discount for preschool students.

Minister

Discounts

Children of church ministerial staff involved in full-time church ministry are eligible to receive a 25% discount on CAC’s K-12 tuition.

Additional Services

Foundations Program

The Foundations Program is designed to address the educational needs of students in grades 6-12 with a primary diagnosis of dyslexia or other language-based learning difference(s). Find out more about the program and tuition here.

Bus Service

CAC offers a variety of bus service plans. Fee information can be viewed on our Bus Enrollment Form.

Extended School Care

Extended School Care is a service available to parents of students in Pre-K – 12th grade. Hours are dismissal to 5:45 p.m. Early morning care is available from 7 a.m. to 7:45 a.m. Fee information is available at the campuses.

Facility & Technology Fee

(per student, nonrefundable, not prorated)

Families with students in grades K-1 are assessed an annual Facility & Technology fee of $300 per student (nonrefundable, not prorated- limit two per family), students in grades 2-6 are assessed an annual Facility & Technology fee of $350 per student (nonrefundable, not prorated- limit two per family) and students in grades 7-12 are assessed a Facility and Technology fee of $450 (nonrefundable, not prorated- limit two per family). This fee may be added to a tuition payment plan of choice. For information on gift exemption options, contact the president’s office at (501) 758-3160 Ext. 223.

Special School Trips

Optional educational, athletic and service trips are offered each year for elementary or high school students (e.g. academic meets, fine arts competitions, European travel, senior trip, etc). Cost is not included in tuition.

Financial Aid

FACTS Grant & Aid Assessment assists CAC in determining financial need. To be eligible to receive financial aid, families must have completed the enrollment process and paid the enrollment fee for the applicable school year. The student must also achieve satisfactory academic progress and meet CAC’s behavioral standards to receive financial assistance.

Families applying for financial aid will need to complete the application and submit the necessary documents to FACTS by March 31, 2023.

Click here to complete the application — Sign in to your ParentsWeb account, navigate to the “Financial” tab then scroll to the bottom of the page and select “Apply for Grant and Aid” under the Financial Links heading. After completing the application, you will be asked to submit the following required forms:

- Copies of your most recent Federal tax forms including all supporting tax schedules.

- Copies of your 2022 W-2 forms for both you and your spouse.

- Copies of supporting documentation for Social Security Income, Welfare, Child Support, Food Stamps, Workers’ Compensation, and TANF.

These documents can be uploaded in PDF format online, faxed to 866-315-9264 or mailed to the address below along with your applicant ID.

FACTS Grant & Aid Assessment

P.O. Box 82524

Lincoln, NE 68501-2524

If you have questions or concerns about the application process, contact FACTS at 866-441-4637.

ACE Scholarship

ACE partners with CAC to offer partial tuition scholarships to students from low-income families so that they may attend the private school of their choice. The ACE scholarship follows the child throughout their K-12 Education.

An ACE Scholarship will pay up to 50% of private school tuition, or a maximum of $3,000 per year for grades K-8 and $4,000 per high school. The families are responsible for working out a payment plan with the school for the remainder of the tuition.

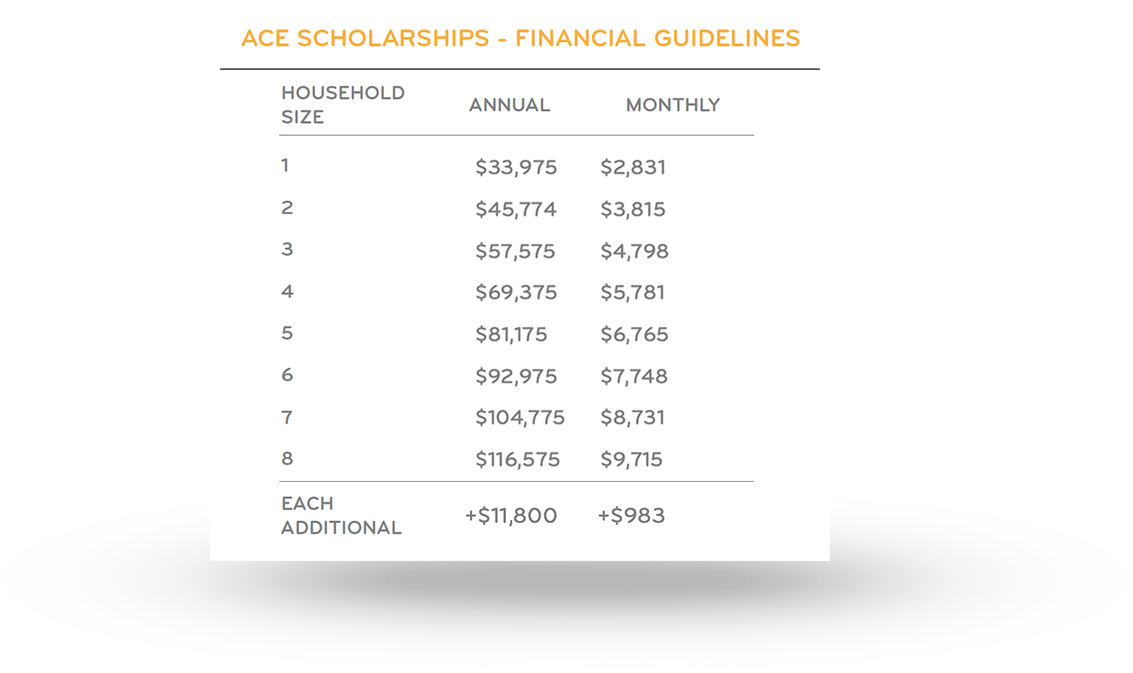

ACE scholarships are based solely on family income, which should not exceed 250% of the federal poverty guidelines. See the chart below for ACE Scholarship financial eligibility.

Applications are completed through FACTS. To apply, click here. The completed application Is due no later than April 30th, 2022. To complete the application, the following is needed:

- 2021 1040 tax form

- Social security, disability, housing allowance, food stamps, child support documentation, and any documentation for additional sources of income that aren’t reported on your 1040

For more information about the ACE Scholarship and ACE Arkansas, visit their website here.